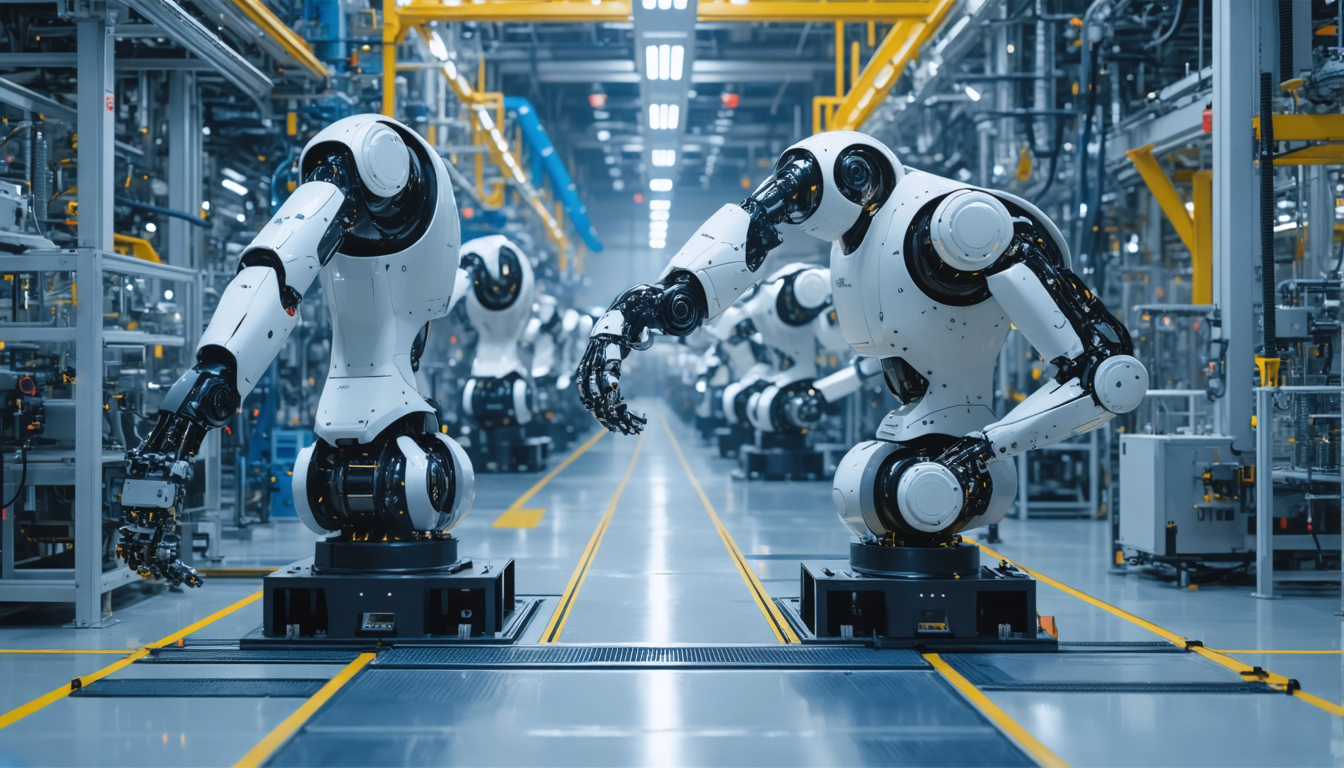

At the dawn of 2025, the investment world is undergoing a profound transformation thanks to the rise of robotics and artificial intelligence. As labor shortages loom on the horizon in many advanced economies, industries are turning massively to automation to maintain their productivity and competitiveness. This dynamic creates fertile ground for innovative investment solutions, among which the Global X Robotics & Artificial Intelligence ETF, often referred to by the ticker BOTZ, particularly attracts the attention of financial experts. This ETF, which brings together key companies in the design and manufacture of robots, appears as an essential lever to diversify and energize a portfolio in search of growth.

In a context where the United States, China, Japan, and Germany face a massive deficit of available human resources in industry, robotics is no longer just an efficiency gain; it is a vital necessity. The challenge goes far beyond the punctual automation of repetitive tasks: it involves reinventing vast economic segments in the face of increasing labor scarcity and rising wage constraints. Thus, with industrial salaries sometimes exceeding $100,000 annually in the United States, the pressure on costs and business continuity pushes companies to integrate robots equipped with advanced intelligence into their production lines.

This industrial overview offers a long-term investment opportunity, despite inherent volatility linked to technological innovation and economic fluctuations. Understanding why and how this robotics-dedicated ETF could transform your asset composition in the coming years is essential for investors wishing to seize a technological revolution full of promise and high return potential.

- 1 How Labor Shortages Drive the Growth of Industrial Robotics and Impact Investments

- 2 The Unique Composition of the Global X Robotics & Artificial Intelligence ETF (BOTZ) and Its Strategic Positioning

- 3 Geographical Diversification Adapted to Global Challenges and Regulations

- 4 Impacts of New American Industrial Policies on Robotics Demand

- 5 Innovation at the Heart of Robotics: From Sensors to Embedded Intelligence

- 6 Challenges and Volatility of Robotics-Dedicated ETFs: What to Expect?

- 7 Future Perspectives of Robotics and Their Influence on Investors’ Portfolios

- 8 How to Integrate a Robotics ETF into Your Investment Strategy for a Diversified and Innovative Portfolio

How Labor Shortages Drive the Growth of Industrial Robotics and Impact Investments

Global demographics are gradually disrupting labor markets. In the United States, nearly 1.9 million production expert positions could remain vacant by 2033. This shortage of skilled labor also strongly affects industry in China, Germany, and Japan, sectors traditionally providers of many industrial jobs. For companies, the shortage is no longer a prospect, but already a tangible reality.

While wages skyrocket — sometimes exceeding $100,000 per year in certain regions — the difficulty in finding competent candidates pushes manufacturers to deploy smarter and more enduring robots.

- Accelerated industrialization: Automata progressively replace positions previously held by humans.

- Technological innovation: The development of sensors and embedded artificial intelligences allows increasingly complex operations.

- Maintaining competitiveness: Automation ensures the continuity of production lines despite the human shortage.

- Cost reduction: In the long term, robots limit expenses related to wage fluctuations and production downtime.

However, this transition to a fully automated industry does not happen without challenges. Companies must invest massively in these technologies and manage a period of adaptation. But the market is doing well: demand for robotic solutions remains strong, even in the face of a general economic slowdown. This makes robotics a key sector for investors seeking growth and medium- to long-term stability, despite short-term volatility inherent in a sector undergoing transformation.

| Country | Projected Industrial Vacancies in 2033 | Average Annual Industrial Salaries |

|---|---|---|

| United States | 1.9 million | $100,000+ |

| China | Several million | Variable |

| Germany | Several hundred thousand | Approximately €70,000 |

| Japan | Several hundred thousand | Approximately €60,000 |

For investors eager to learn more about investment prospects in this sector, this article offers a detailed analysis of the robotics-dedicated ETF, explaining why it could experience significant growth in the coming years.

The Unique Composition of the Global X Robotics & Artificial Intelligence ETF (BOTZ) and Its Strategic Positioning

At the heart of this revolution, the Global X Robotics & Artificial Intelligence ETF, known by the ticker BOTZ, stands out for its targeted approach, concentrating its portfolio on 53 major companies active in robotics and AI. This fund appears as a privileged gateway to investing in the physical and software infrastructure underlying the new industrial revolution.

The top ten holdings of BOTZ account for nearly 60% of its assets, highlighting the considerable weight of technology giants capable of shaping the future. Notably:

- Nvidia (11.8%): Isaac robotic acceleration platform and the GR00t model to reduce development cycles.

- ABB (8.9%): World leader in industrial robotics and smart electrification.

- Fanuc (7.6%): Japanese specialist with a vast global fleet of operational robots.

- Intuitive Surgical (7.3%): Reference in the medical sector with its da Vinci surgical systems.

- Keyence (5.7%): Pioneer in industrial vision and sensors.

These players represent not only technological success but are the foundations of an automation demand that is destined to grow inexorably. BOTZ is not just a typical tech fund but specifically targets the mechanics, electronics, and software of tomorrow that will build embedded AI in machines.

| Company | Weight in ETF (%) | Main Activity Sector |

|---|---|---|

| Nvidia | 11.8 | AI platforms for robots |

| ABB | 8.9 | Industrial robotics and electrification |

| Fanuc | 7.6 | Robotic automation |

| Intuitive Surgical | 7.3 | Medical robotics |

| Keyence | 5.7 | Industrial vision |

To deepen your investment options in this technological evolution, this guide presents the must-have ETFs in the sector.

Geographical Diversification Adapted to Global Challenges and Regulations

BOTZ distributes its assets strategically worldwide, with a dominant presence in the United States (49%), followed by Japan (26%), Switzerland (9%), and South Korea (4%). This geographical distribution reflects a clear intent to minimize risks related to unstable markets, notably China, whose regulation can affect company valuation.

Japan, for example, benefits from strong expertise in robotics thanks to heavyweights like Fanuc. These companies also prosper due to the increasing relocation of production chains outside China to countries with more controlled costs, such as the United States where Fanuc invests in a Michigan factory.

- Reducing dependence on Chinese markets: Limiting risks associated with unpredictable regulation.

- Focus on American innovations: Capitalizing on the new CHIPS and IRA laws that accelerate the construction of advanced plants.

- Synergies with Asian producers: Supporting the growing exports of Japan and South Korea.

This geographical mix is an asset for an ETF concentrated on technology and robotics, enabling the capture of opportunities at the heart of the most advanced and dynamic industrial zones.

| Region | Share of Assets in BOTZ (%) | Strategic Advantage |

|---|---|---|

| United States | 49 | Innovation center, favorable regulatory momentum |

| Japan | 26 | Robotics technological expertise |

| Switzerland | 9 | Specialized contributions in instrumentation |

| South Korea | 4 | Advanced technology in electronics and robotics |

To learn more about geopolitical aspects impacting robotics, you can consult this in-depth analysis on the robotics revolution in China as well as robotic developments on the Indian border.

Impacts of New American Industrial Policies on Robotics Demand

The United States recently adopted ambitious laws like CHIPS (Creating Helpful Incentives to Produce Semiconductors) and IRA (Inflation Reduction Act), which strongly stimulate the industrial sector, notably in semiconductor and battery manufacturing. These measures encourage the creation of new cutting-edge factories, generating a direct increase in demand for advanced robotic equipment.

This dynamic aligns with the expansion of industrial robotics and offers interesting visibility to investors. For example:

- A boom in industrial investments: Billions of dollars aimed at modernizing facilities.

- Increased automation needs: Each new factory will integrate a significant number of robots.

- Trend sustainability: These long-term projects maintain stable demand over several years.

Companies in BOTZ are already positioned to capture this growth, preparing to equip future industrial lines with robotics. This aspect highlights why this ETF is more than a simple tech vehicle; it is a strategic response to industrial structural transformations.

| Law | Effect on Industry | Impact on Robotics |

|---|---|---|

| CHIPS | Construction of new semiconductor factories | Intensified demand for specialized robots |

| IRA | Support for battery manufacturing and green technologies | Increased integration of robotic automation |

To follow in real-time the opportunities related to the ETF and robotics, visit this comprehensive thematic guide on automation and robotics.

Innovation at the Heart of Robotics: From Sensors to Embedded Intelligence

Modern robotics pushes the limits of technology through numerous innovations, notably in the fields of sensors, industrial vision, and embedded artificial intelligence. These advances now allow robots to perform complex tasks, adapt to their environment, and interact with humans across various sectors.

- Advanced sensors: Enable robots to perceive their environment with extreme precision.

- Industrial vision: Facilitates sorting, quality control, and increased automation through real-time image analysis.

- Embedded AI: Gives machines the ability to learn and make autonomous decisions.

- Robotic simulation: Optimizes development and implementation through realistic virtual environments.

A company like Nvidia, with its Isaac platform, perfectly illustrates this trend. Its GR00t model shortens robotic design cycles by simulating complex interactions even before physical manufacturing. Intuitive Surgical leverages AI to refine robotic interventions in surgery, a sector that has experienced strong technological expansion in recent years.

| Technology | Main Contribution | Example Company |

|---|---|---|

| Sensors | Environmental perception | Keyence |

| Industrial vision | Automation of quality control | Keyence |

| Embedded artificial intelligence | Learning and autonomous decision-making | Nvidia, Intuitive Surgical |

| Simulation | Reduction of development cycles | Nvidia |

These innovations are essential drivers of robotics’ rapid growth and extend their impact far beyond the traditional industry alone. To learn more, discover the best robotics investment opportunities.

Challenges and Volatility of Robotics-Dedicated ETFs: What to Expect?

Investing in a robotics-centric ETF like BOTZ offers undeniable growth prospects but also exposes holders to significant volatility. Several factors can influence the value of these funds:

- Rapid pace of innovation: New technologies can disrupt the market.

- Intense competition: Numerous innovative players frequently change market shares.

- Macroeconomic factors: Inflation, geopolitical crises, or slowdowns impact industrial investments.

- Regulation and public policy: Policies can favor or hinder certain segments.

For savvy investors, this volatility can turn into an opportunity. It is about holding this type of ETF with a medium- to long-term perspective, incorporating a diversified strategy that smooths fluctuations without giving up potential gains.

| Factor | Potential Impact | Adaptation Strategy |

|---|---|---|

| Technological innovation | Sharp decrease or increase in values | Active monitoring, diversification |

| Competition | Rapid change of leaders | Sector watch |

| Macroeconomics | Increased volatility | Balanced portfolio |

| Regulation | Regulatory risk | Policy analysis |

To better understand and manage risks linked to this type of investment, feel free to consult this complete guide on robotics investment.

Future Perspectives of Robotics and Their Influence on Investors’ Portfolios

Beyond classic industrial robots, humanoid robotics and domestic applications will experience unprecedented growth, supported by advances in artificial intelligence and connectivity. Fund projects specializing in humanoid robotics are emerging as major innovations to capture this trend.

Moreover, the convergence between AI, robotics, and connected objects opens highly promising transversal investment areas, notably in:

- Connected health: Surgical robots and personalized care.

- Building automation: Maintenance robotics and energy management.

- Autonomous vehicles: Synergy between robotics and AI for innovative mobility.

- Service robotics: Assistance for the elderly or disabled.

With the robotics industry expected to quadruple its size in the next decade, portfolios integrating these themes could benefit from strong long-term return potential.

| Sector | Example Application | Growth Potential |

|---|---|---|

| Health | Surgical robots, assisted diagnosis | Very high |

| Smart building | Automated maintenance | High |

| Autonomous mobility | Autonomous vehicles | Strong |

| Service robots | Personal assistance | Rapid growth |

To follow investment opportunities in these sectors, discover our selection of the best ETFs dedicated to artificial intelligence and robotics.

How to Integrate a Robotics ETF into Your Investment Strategy for a Diversified and Innovative Portfolio

Robotics represents a technological disruption that requires a strategically preceded approach. Integrating an ETF such as BOTZ into a financial portfolio requires respecting some key rules:

- Assess risk tolerance: Robotics is a rapidly evolving sector with ups and downs.

- Allocate a reasonable share: Do not concentrate investment solely in one technological segment.

- Monitor innovation evolution: Maintain regular watch to adjust the composition.

- Prefer geographical and sector diversification: Avoid overexposure to a single market.

This strategy helps maximize the growth potential offered by robotics while limiting the volatility inherent to this type of asset. By its nature, the ETF facilitates exposure to robotics leaders without requiring a highly selective stock picking.

| Step | Advice | Expected Benefit |

|---|---|---|

| Investor profile analysis | Define risk tolerance and investment horizon | Investments adapted to your goals |

| Asset allocation | Incorporate a reasonable share of robotics ETF | Exposure to technological growth |

| Monitoring and adjustment | Update portfolio according to trends and performance | Yield optimization |

| Risk management | Maintain strong geographical and sector diversification | Reduction of overall volatility |